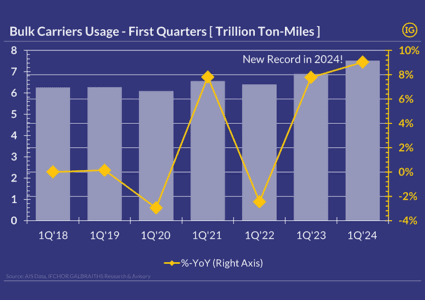

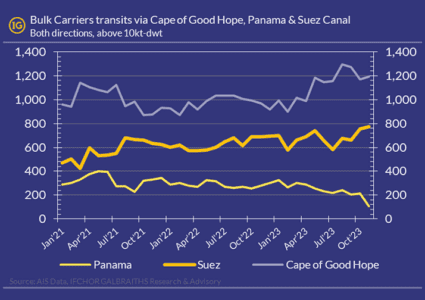

New milestones for Bulk carriers? In 1Q’24, the utilization of the Bulk Carriers fleet (>10kt-Dwt) rose +9% YoY to a new seasonal record of 7.5 trillion ton-miles during a Q1.

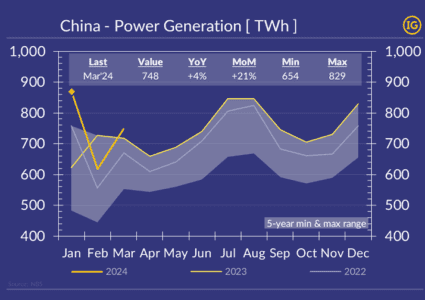

China’s power generation confirm positive PMI studies in March!

Despite milder weather, China’s power generation still progressed +4.2% YoY in Mar’24 and +8.1% YoY in 1Q’24 for a total of 2.2PWh (i.e. 2.2 million of billion watt-hour)!

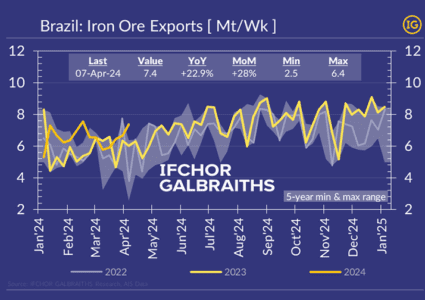

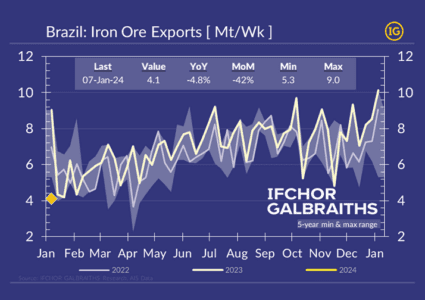

Brazil’s weekly iron exports resurge to high levels

Iron ore exports from Brazil have recovered to 7.4Mt/wk, at a seasonal record for the second time in 2024.

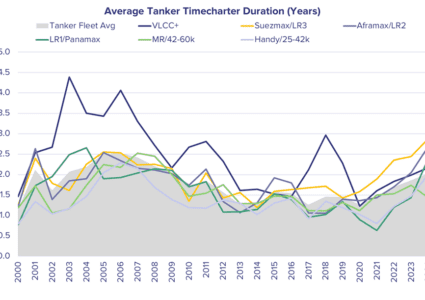

Increasing Focus on Longer Duration Timecharters

Across many tanker segments the average duration of timecharters has been on the rise, with 1Q2024 showing no signs of that trend slowing down.

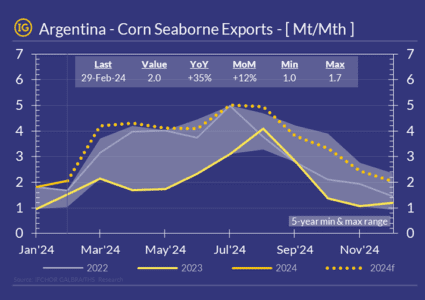

Argentina corn exports to drive growth of agri-freight demand in 2024

With corn harvest in Argentina underway and nearly 6% complete (+2% WoW), the full crop in 2024 is…

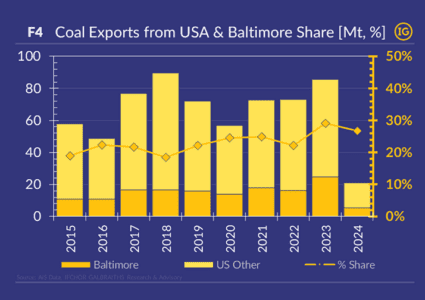

Baltimore Bridge Collapse & Consequences for Global Coal Trade

It took 2 consecutive power failures at the worst possible moment for container ship M/V Dali to ram and totally…

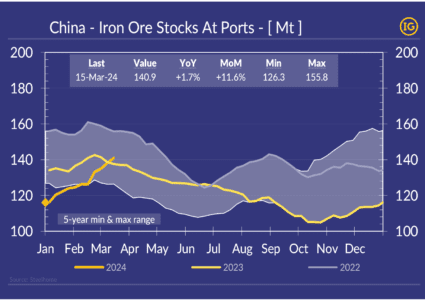

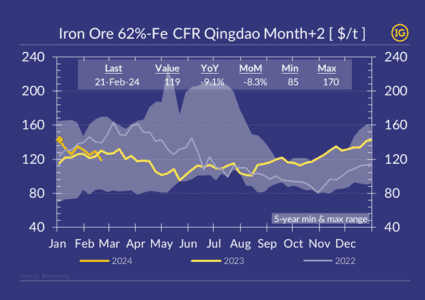

Iron ore restocking in China accelerates!

Healthy supply of iron ore and prices relaxing through 1Q’24 have encouraged Asian steel mills to accelerate the pace of restocking in the past month.

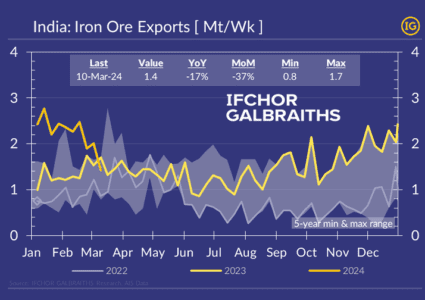

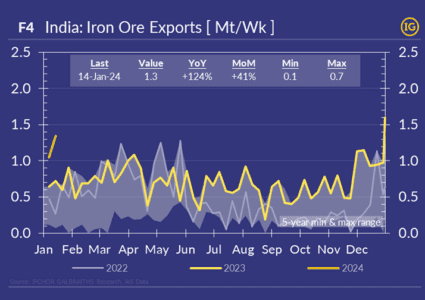

India’s Iron Ore exports slid from 5-yr high to 5-mth low!

Price sensitivity or seasonal evolution? Climaxing at 2.8Mt/wk at the start of 2024 and mirroring SGX iron ore prices then over 140$/t, iron ore exports from…

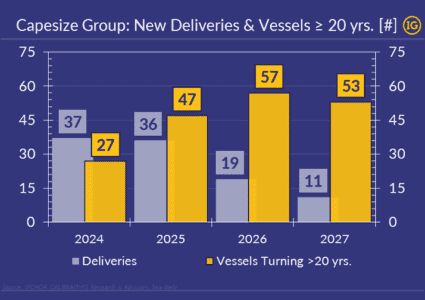

Towards tightening Capesize Supply: Fleet ageing versus Orderbook!

Despite a regain of interest during 2020/2021 on the back of post-covid stimulus plans, recent ordering activity for Capesize bulk carriers (i.e. 100 – 220kt-Dwt) has led to…

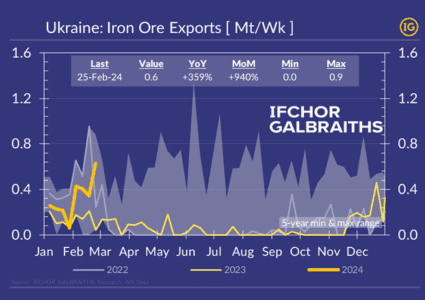

Ukrainian seaborne iron ore exports have resumed at full speed, and it is good for overaged Capesizes!

From last November onwards, Ukraine has progressively resumed seaborne exports of iron ore after a 18-month interruption due to the war.

Iron ore prices relaxing on rising supply & more aggressive sales?

Initially pricing a premium for low inventories in China and uncertain seasonal weather conditions…

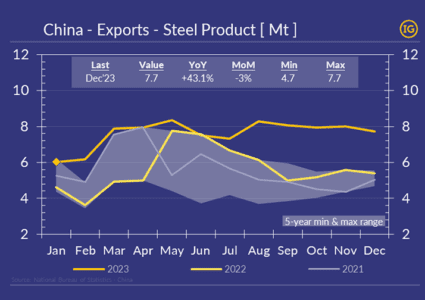

Where are Chinese steel exports heading into 2024?

Looking at 2023, steel exports from China rose +35% YoY to a 7-year high at 91Mt.

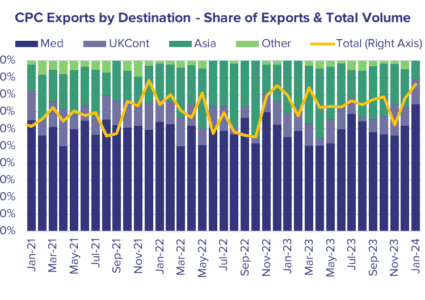

Reduced Crude Volumes from CPC heading East

2024 has seen CPC barrels stay local at the expense of volumes heading East, as the Red Sea crisis shifts tradeflows.

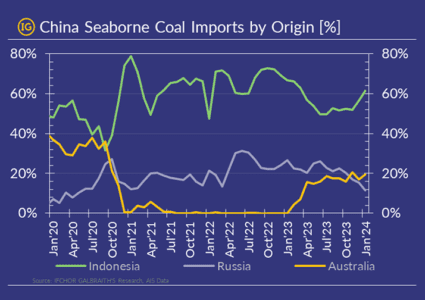

In recent months, Australia overtook Russia as a coal supplier to China!

Nothing can beat a good logistics on the long run!

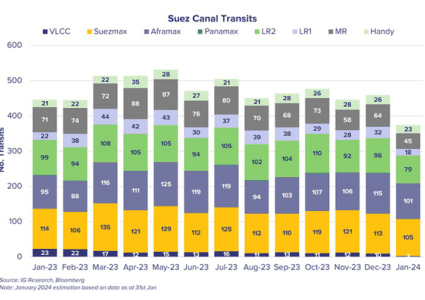

Red Sea Tanker Update

The situation in the Red Sea remains volatile. Explore the impact seen so far on the tanker markets.

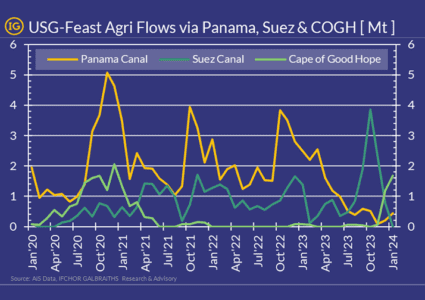

Visualizing the impact of transit restrictions across Panama Canal & the Red Sea on agri exports from the USG to the Far-East

The preferred shipping route for dry-bulk exports…

Have steel production margins in China bottomed?

Have steel production margins in China bottomed? Since peaking in Sep’21, margins have experienced a dead-cat bounce in 2023 before reaching a trough in Dec’23.

Iron ore exports from India have soared in recent weeks!

Recovering after the monsoon season and supported by iron ore prices trending upwards in 2H’23, India’s iron ore exports have climbed above 5-year high levels.

Sharp seasonal slow-down for Brazil iron ore exports in early Jan’24!

Despite ending 2023 at 5-year high levels and posting a new record at 10.1Mt/wk on the week connecting 2023 to 2024…

When plan B does not calculate anymore! The recent re-routing of Bulk Carriers heading to Asia via Panama to Suez, and later to Cape of Good Hope

The shift to Suez Canal from Panama, coupled with escalating Middle East violence, is rapidly reshaping bulk carrier routes to the Far-East, impacting fleet utilization in the North Atlantic.