Open any tanker report over the past twelve months and you are likely to see reference to a ‘tightening tanker fleet’. The supply side continues to be a source of significant optimism amongst owners over the medium term, despite the recent uptick in orders, with a combination of a relatively limited orderbook in many segments along with a rapidly ageing fleet contributing to the expectations for an elevated tanker market into the latter half of the decade.

Fewer vessels on the water, and an increasingly complex and volatile freight, have seen an increased desire amongst participants to control tonnage. This has helped contribute to elevated timecharter rates; with a 1yr TC rate for an Eco, Scrubber VLCC currently sitting at around US$ 58,500 / day, but have also seen a developing trend where increased focus is being placed on longer duration timecharters, as participants seek greater clarity on freight exposure over the medium-term time horizon.

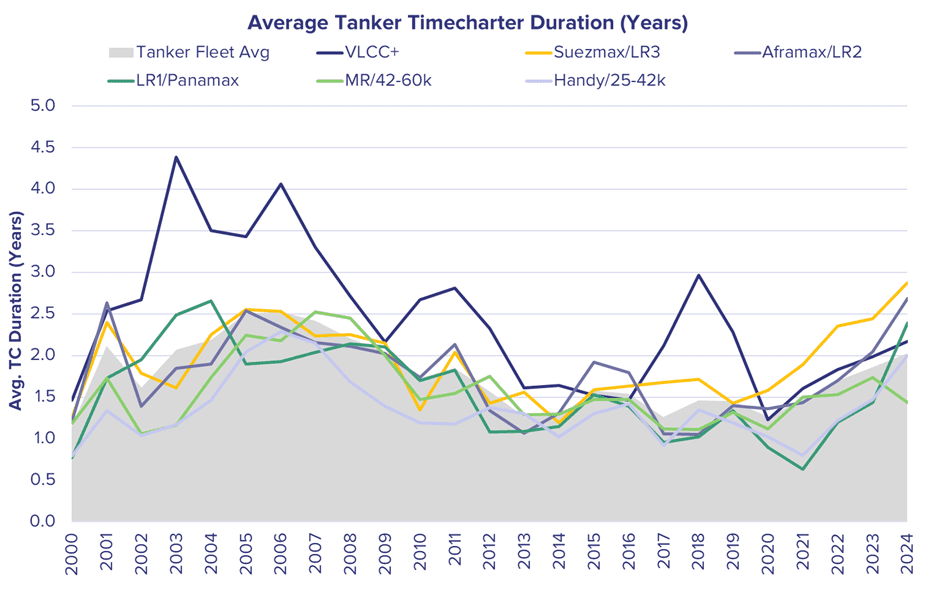

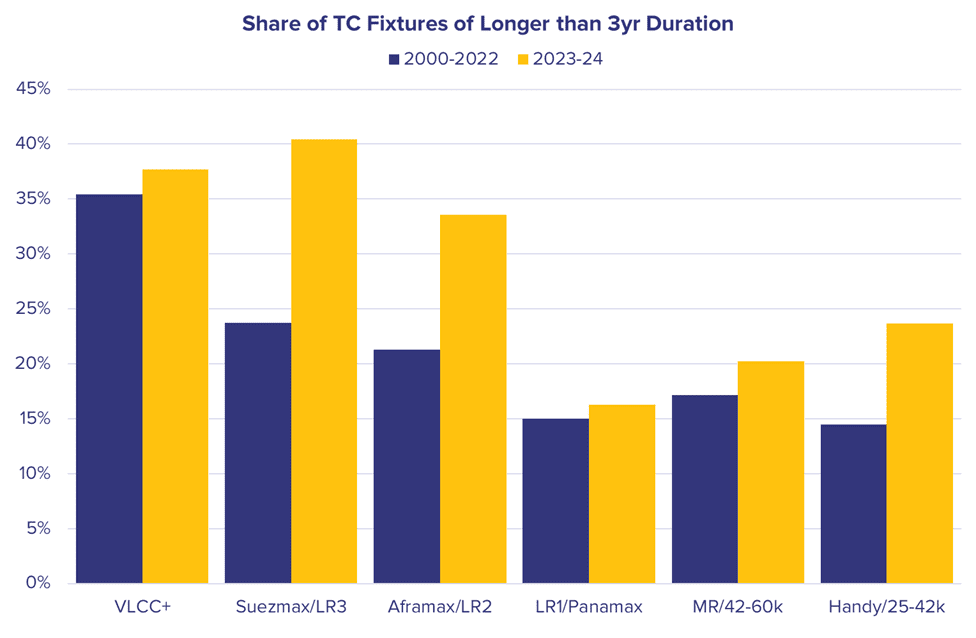

Based on reported timecharter fixture data (and excluding shorter term TC deals of less than 6-month duration); with a handful of exceptions, almost every segment of the tanker fleet (VLCC to Handy) has seen multi-year increases in the average length of TC, with that average peaking so far throughout the first quarter of 2024. The Suezmax fleet is a textbook example of this trend, where average timecharter duration sat at just under 1.5 years in 2019, with it now sitting at just shy of an average of 3 years so far in 2024. Across 2023-24 a total of just over 40% of reported timecharter fixtures were of at least 3 years duration, a dramatic increase compared to the 23.75% of reported fixtures seen across the longer timeframe of 2000-2022.

This trend is mirrored in the wider tanker fleet, where for the first time since 2009 average timecharter duration has increased past the two-year mark, sitting at an average of 2.03 years.

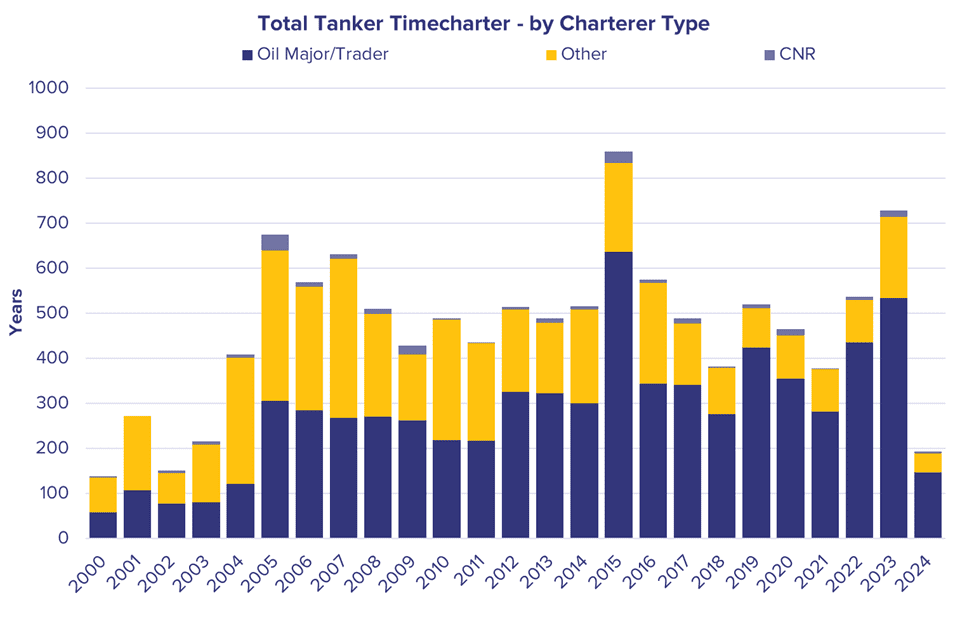

The increasing durations have seen a cumulative total of just over 920 years of timecharters across 2023 and the first part of 2024, with oil majors/traders taking a significant chunk of that business. With this increase in vessels locked on TC, the pool of tonnage across the tanker market willing to do timecharter business is shrinking significantly, a tightness exacerbated by the limited new tonnage coming into the market over the near term.

For further information, or for additional queries, please contact [email protected].