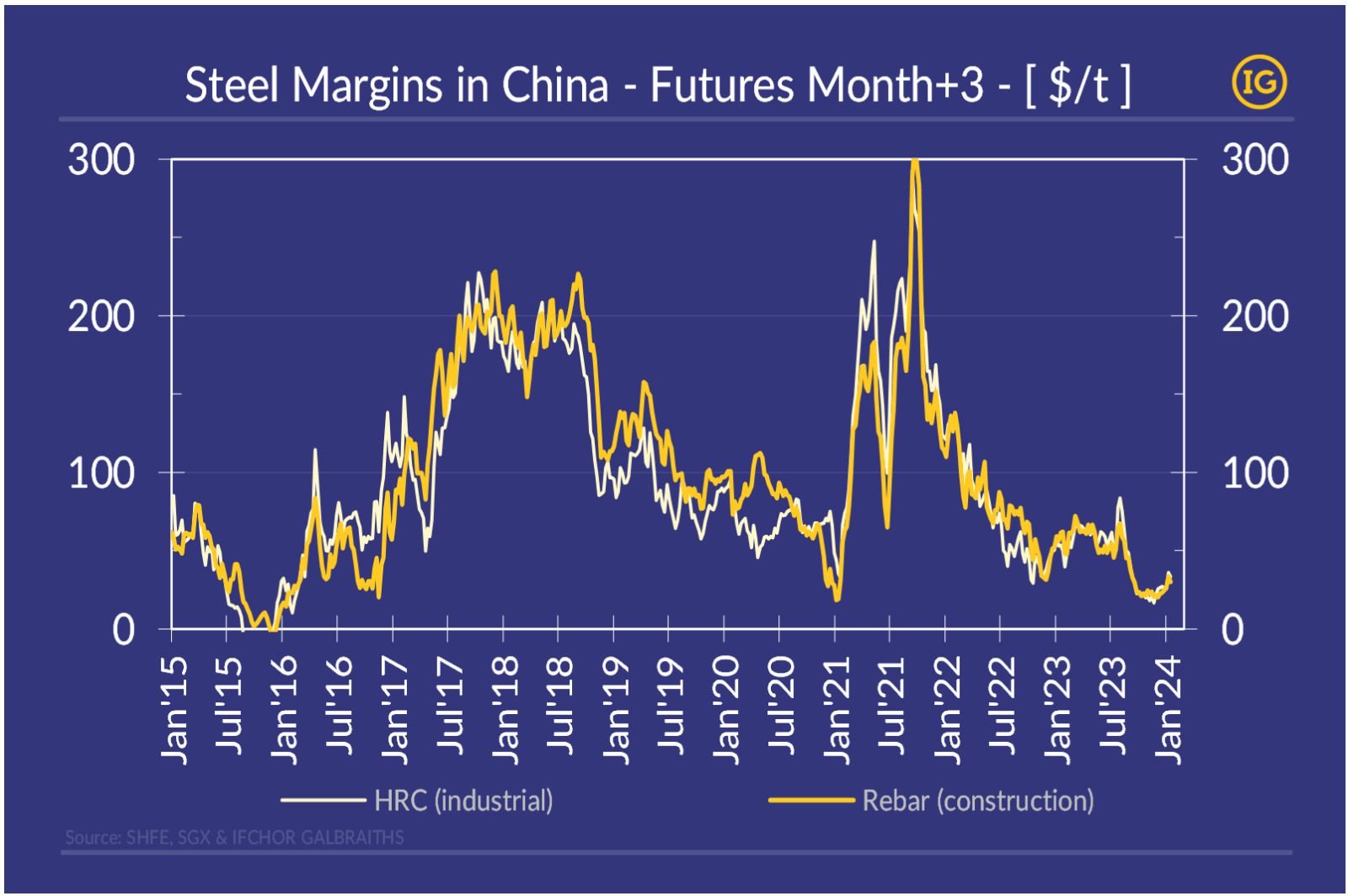

There are several hints suggesting the year of the Dragon will coincide with a new steel cycle. Whilst the periodicity of the margins and short-term technical analysis on steel prices points at near-term improvements, there are also lower-frequency signals. For example, the multiplication of M&A and assets (temporary-)closure across the globe in 2H’23, or the accumulation of greenfield iron ore mining projects are also supporting structural margins improvement going forward.

If you would like to get more information on this topic and the impact on the freight market, please reach out to us on: [email protected].