Rerouted shipping via Cape of Good Hope raises emissions, with a modest immediate EUA demand impact. Read the latest IG Sustainability short report analysing costs, risk, and environmental implications.

Discovery & Execution

The cost of carbon in goods and supply chains is impacting the economics of freight.

Understanding carbon market pricing dynamics will be fundamental to quantify and manage this additional financial exposure as environmental policies and regulations intensify under consumer pressure.

Working closely with our carbon market specialist partner ClearBlue Markets.

We offer compliance and voluntary carbon markets advisory, research reports and insights, fundamental and technical analysis, proprietary carbon prices forecasting, bespoke carbon position strategy development, implementation, and risk management. This is combined with direct carbon markets access for seamless broking and execution.

More about IG Sustainability

IG SUSTAINABILITY

Working towards a zero-carbon maritime industry

Inside the EU-ETS Era

As COP28 calls for fossil fuel abandonment, the shift to green fuels necessitates substantial financial investment and cross-industry collaboration for effective decarbonisation. The EU-ETS, now live and counting, offers a framework for impactful maritime sector transformation.

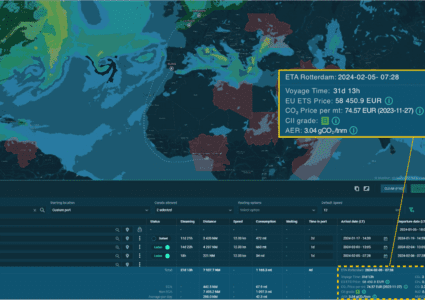

Maritime Carbon Solutions’ Emissions Estimator gives predictability on voyage costs with EU ETS on Orbit platform

MCS, a joint venture between IFCHOR GALBRAITHS and OrbitMI, utilizes an Emissions Estimator tool, powered by AI and voyage data that provides real-time CO2 predictions, supporting shipowners in EU ETS preparation and compliance.