Despite the price cap and sanctions regime, CPC volumes have remained healthy, thanks to targeted exemptions for the Kazakh origin grade.

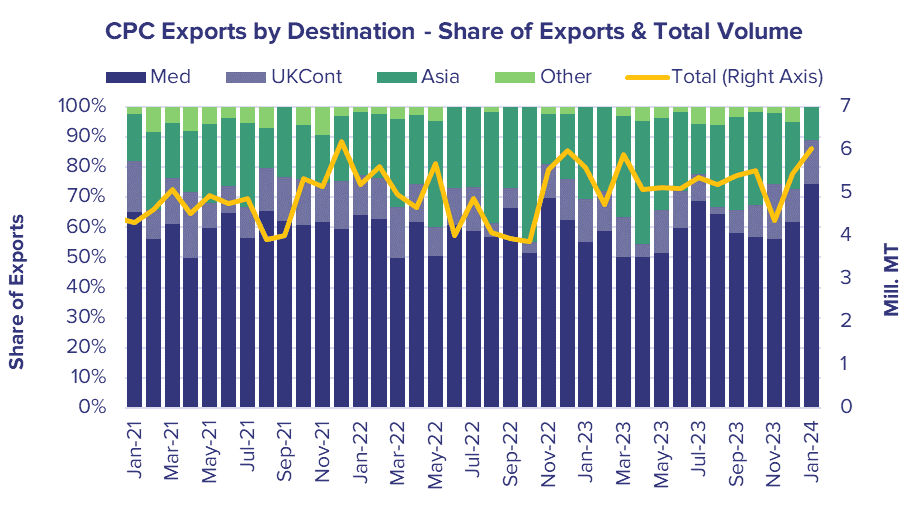

The destinations of these export volumes have however begun to alter significantly over recent weeks. On average across 2023, just under 30% of CPC exports headed East of Suez, with a peak in April-2023 of 44%. In Jan-2024, only 11% of monthly barrels have headed East of Suez, with the vast majority of volumes instead staying in the Med & UKCont.

The Red Sea crisis is clearly impacting on CPC flows, keeping barrels local. This is likely to benefit Aframaxes most significantly, with that size enjoying the highest CPC export volumes in the past two years. Suezmaxes remain the segment of choice for Eastbound barrels will be utilised for longer, with at least 40% of those vessels used for Jan-24 eastbound liftings heading via the Cape.

The largest East of Suez takers of CPC crude; India, South Korea and China in particular, will be sourcing some replacement barrels should this trend continue, and this will be a trend to watch closely over the coming months.