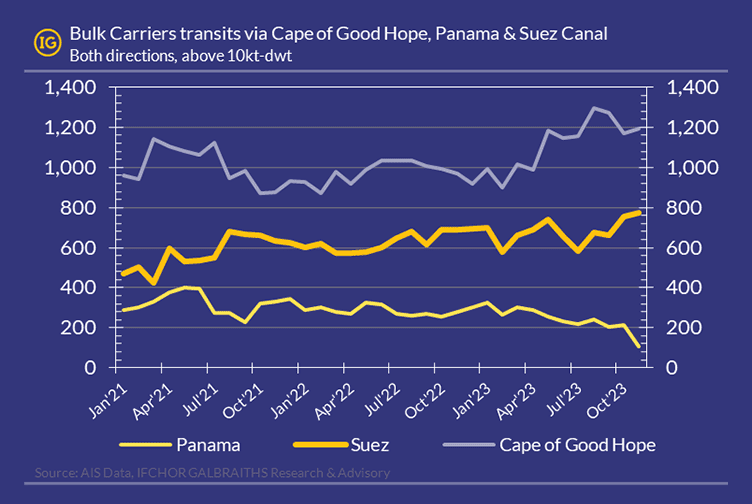

After that critically low water-level in Panama had resulted in drastic reductions of the canal’s transportation capacity and transit prices incompatible with shipping economics of dry-bulk cargoes, the flow of bulk carriers heading to the Far-East was re-routed to the Suez Canal after the Summer. The switch was brisk enough to halve the number of bulk carriers transiting via Panama (record low of 106 ships/month) in favor of the Suez Canal (record high of 772 ships/month).

With violence erupting in the Middle-East, the re-routing of bulk carriers heading to Asia & the Far-East is evolving quickly. Together, rising insecurity in the Red Sea combined with cheaper marine fuel prices since October have made ships transit to Far-East rather via the Cape of Good Hope at current market levels.

In the eventuality of this situation persisting, the implied increase of ton-miles for the bulk carriers’ fleet and the longer duration to reposition ships in the Atlantic would likely result in rising fleet utilization and more frequent shortage of ships in the North Atlantic area (incl. nearby seas such as the Black Sea).

If you would like to get more information on this topic and the impact on the freight market, please reach out to us on: [email protected].