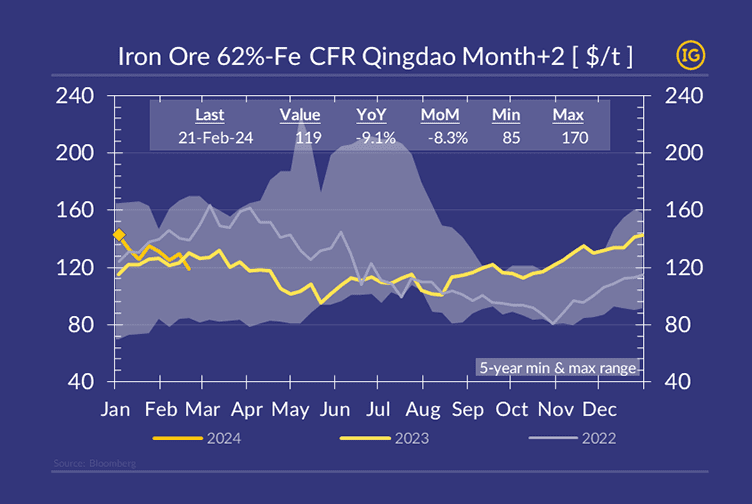

…at key iron ore exporters in Q1 (e.g. cyclone season in Australia), SGX iron ore futures contract for month+2 delivery started the year at 143.5$/t, then progressively eroded with a slow yet steady recovery of inventories in China. The descending momentum has accelerated after Lunar New Year holidays in Asia with prices dropping ~10% since last week to 119$/t.

On the supply side, thanks to mild weather condition at exporters and countries such as India or Ukraine accelerating seaborne exports, global iron ore shipments rose above 5-year seasonal highs in recent weeks. With 11 OECD countries in economic recession (incl. Japan & Germany) in 4Q’23 and a steady deterioration of steel production margins that led to titanic M&A’s within the global steel industry at the end of 2023, iron ore prices are adapting and miners became inclined to push sales more aggressively than in previous years!

If you would like to get more information on this topic and the impact on the freight market, please reach out to us on: [email protected].