The situation in the Red Sea remains volatile and unpredictable, with the presence of coalition warships and missile strikes into Yemen seemingly having little immediate impact on the threat to commercial shipping. In recent days attacks have continued, with the LR2 ‘Marlin Luanda’ being the latest affected vessel of the conflict from within the tanker segment.

Since the beginning of the sustained attacked in mid-November, commercial shipping owners, operators and cargo interests have altered behaviour, with a number of key players choosing to avoid the chokepoint of the Bab-el-Mandeb completely and sending vessels via the Cape of Good Hope (CoGH) instead of the shorter, quicker and cheaper route via the Suez Canal.

At the time of writing, tanker market participants are taking different approaches to transiting the Red Sea, however the impact of rerouting can be stark. An LR2 lifting from Ras Tanura into Amsterdam, would see the laden transit jump from 6,475nm to 11,241nm, an increase equivalent to an extra circa 17 days of sailing (at 12knts). This creates further inefficiencies in the tanker market, increasing the demand for tankers substantially and pushing the floor for freight ever higher.

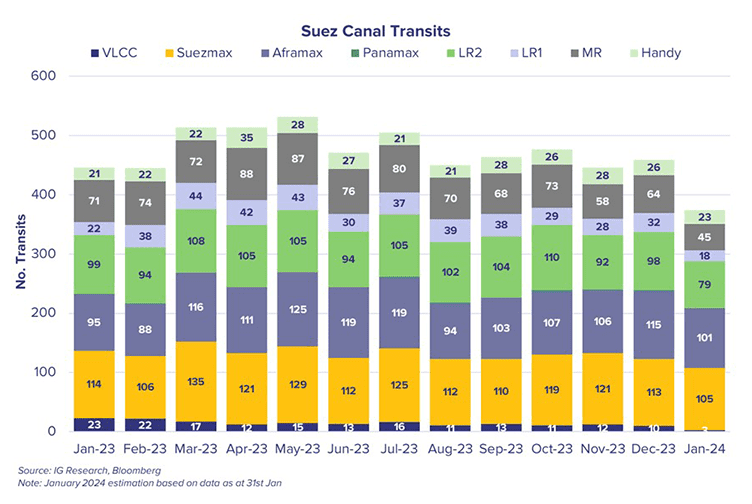

The key question heading forward is to the extent that vessels will seek to avoid the Red Sea. With January now complete, the data can be looked at more closely. For crude tankers the impact has been more muted than in other segments, with total January transits sitting at 206 vessels. This represents a decline on 2023 average levels by about 12%. Clean tankers have seen a far more significant decline, in total across the fleet a drop of around 22% relative to 2023 annual levels has been seen during January 2024. Amongst this segment, LR2, LR1 and MRs have seen declines of 22%, 46% and 37% respectively.

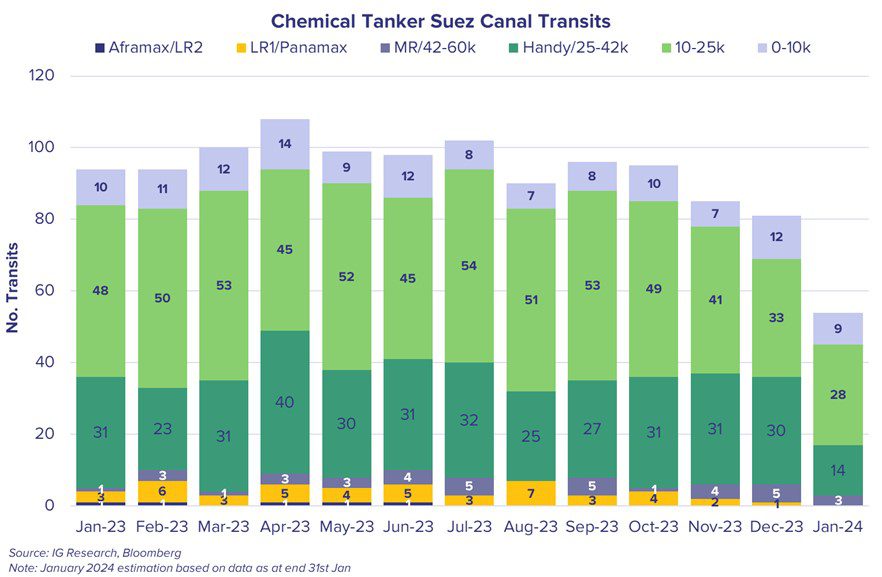

These figures are all outstripped by the declines seen for Chemical tankers, where transits of the Suez Canal have fallen significantly both in month-on-month terms and compared with average 2023 transit levels. Compared to that annual average, transits for January are down 41% across the segment as a whole for January 2024.

A significant change in the market has been the sharp increases in Additional War Risk Premiums (AWRP), with these insurance costs for a Suezmax Indian Ocean Transit jumping from ‘75M @ 0.03% less 50% NCB less 25% extra discount’ on 14th December 2023, to sit at ‘75M @ 0.75% less 50% NCB’ by the 31st January 2024. In dollar terms this translates to an increase in AWRP from circa US$ 5,625 to sit around US$ 281,250, a 4,900% increase.

As the market heads into the rest of 2024, the situation in the Red Sea shows little sign of an immediate resolution. Even without any further escalation, the status quo extends the existing inefficiencies in the market, tying up tankers and keeping the market significantly tighter than normal.

Going forward, to keep abreast of the latest situation and the impacts on the market please reach out to us at [email protected] to enquire about our most recent Red Sea Report.