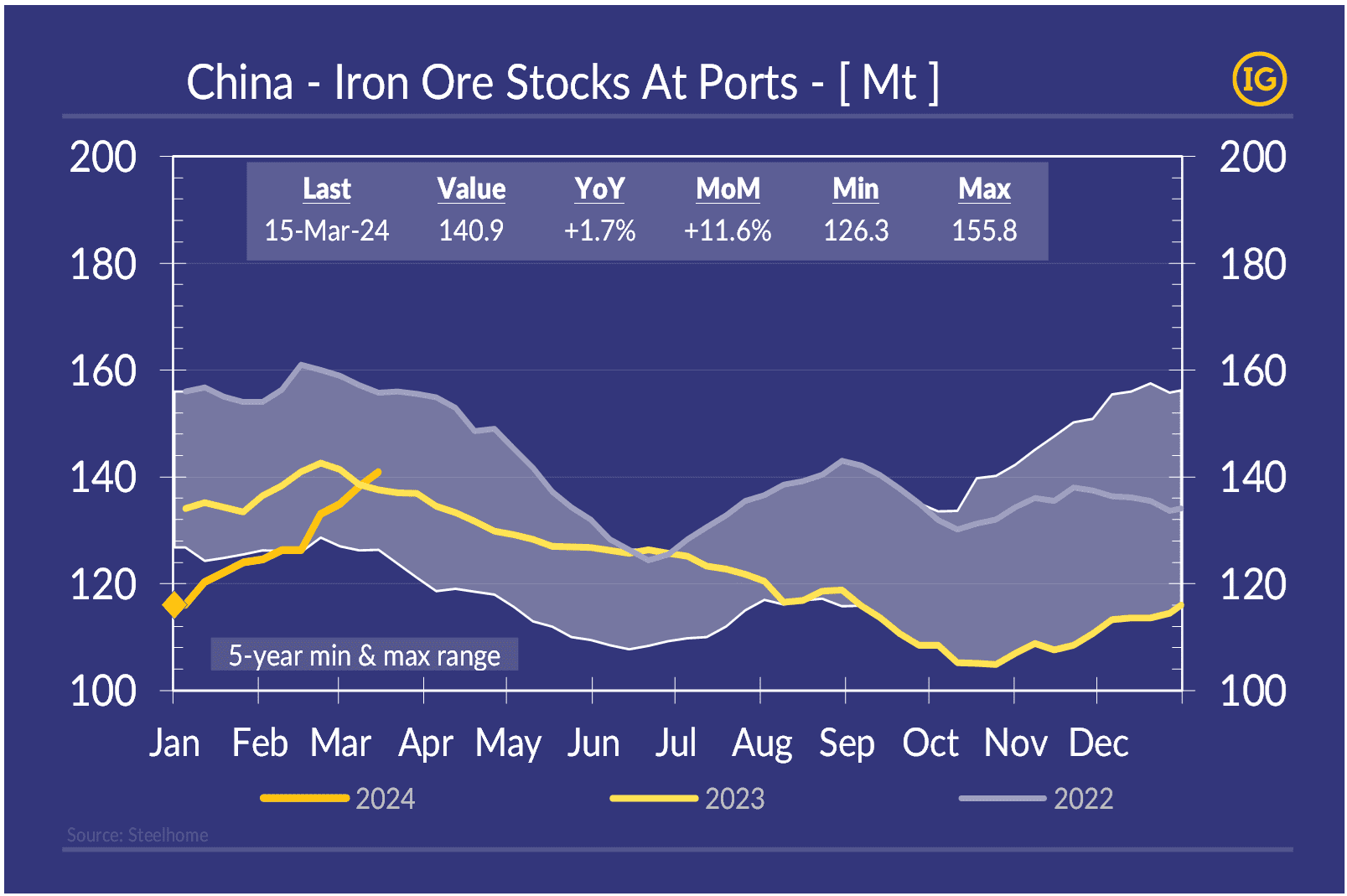

Given SGX iron ore contract for April delivery exchanged briefly under 100$/t this week, the seasonal acceleration of exports in Q2 and the relative weakness of blast-furnace iron in China so far in 2024, the current restocking momentum is likely to continue in the coming weeks. With inventories at ports reported at 141Mt last week, there is still room for another 21Mt before reaching the record at 162Mt that was reached in 2018.

If you would like to get more information on this topic and the impact on the freight market, please reach out to us on: [email protected].