Routing ships around the Cape of Good Hope to circumvent potential threats in the Red Sea increases emissions when compared to routing directly through the Suez Canal. However, the knock-on effect on demand for EUAs stemming from increased emissions due to vessels’ longer routing is nonetheless expected to be marginal, at least in the immediate.

This is largely due to the maritime sector accounting for a relatively small share of the total EU ETS market, roughly 7.58% once fully phased in, coupled with a phased implementation approach, where for the first compliance period of the EU ETS scheduled by end Sept 2025, only 40% of the reported emissions in 2024 will necessitate the acquisition of EUAs and for inbound or outbound European voyages affected by the situation in the Red Sea, only 50% of those reported emissions will fall under the scope of the EU-ETS.

Whilst in the immediate Red Sea navigational disruptions may exert moderate pressure on EUAs demand, the repercussions could potentially become more significant over the medium or longer term if disruptions persist, given the greater share of maritime emissions becoming subject to compliance requirements, specifically 70% and 100% of reported emissions for 2025 and 2026 respectively.

The shift has been causing notable disruptions in the global shipping landscape, affecting international commerce by prompting adjustments in industry strategies toward the EU-ETS. For instance, one major shipping container line operator has updated its’ EU-ETS surcharge rates to reflect longer journey times. Around 15% of seaborne trade, and approximately 7% of seaborne dry bulk trade, flows through the Red Sea and Suez Canal, and the detour via the Cape adds on average about ten days extra to voyages to and from Europe, affecting global trade dynamics and increasing freight costs. Additionally, insurance premiums for vessels in the Red Sea have gone up by 0.5-0.75 percentage points, according to various maritime insurance sources.

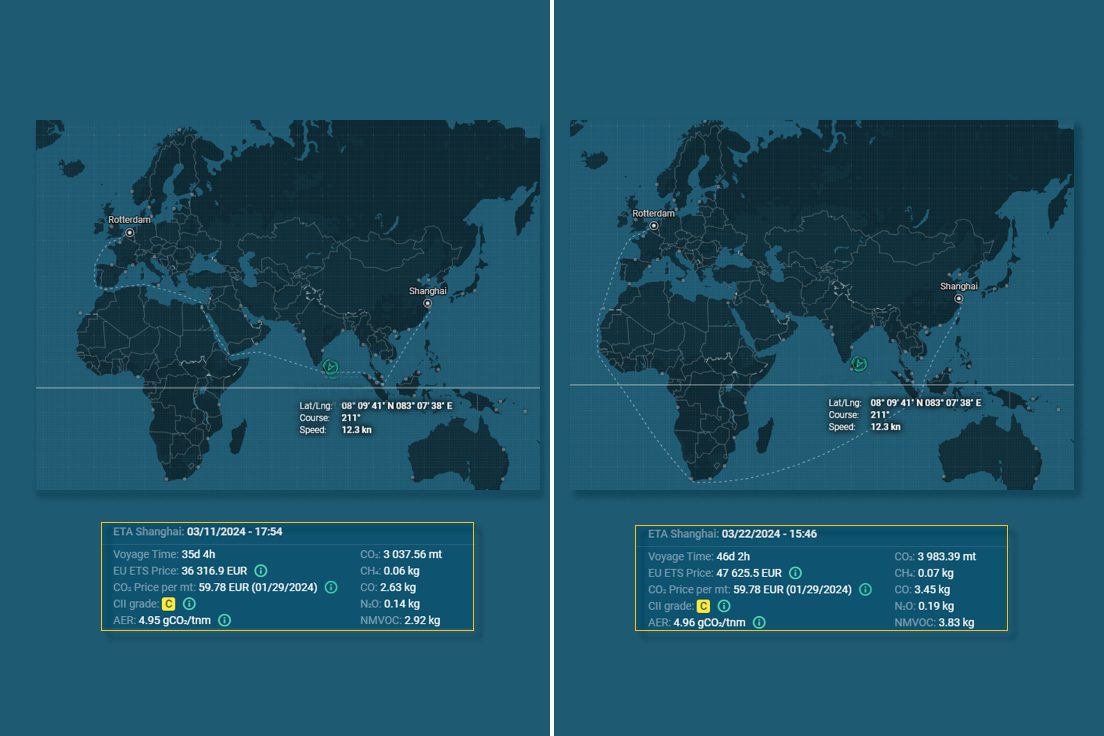

Our analysis on the Maritime Carbon Solutions platform for the same (laden) sea passage from Rotterdam to Shanghai, for a non-scrubber fitted 76,000 dwt Panamax vessel built 2010 proceeding at eco speed, shows that the Cape of Good Hope detour results in approximately 925 metric tons more CO2 emissions versus routing via Suez, due to the extended steaming.

While the Carbon Intensity Indicator (CII) values for either routing suggests similar fuel efficiencies, the EU-ETS costs at current spot EUA prices for the Cape route exceed those of the Suez route by EUR 11,309, a reflection of the absolute increase of CO2 output. Notably, the Cape route avoids the Suez Canal fees & extra war risk premiums, which at today’s market rates could potentially amount to around USD 390,000. Additional steaming time however results in extra voyage costs, specifically an extra 11 days hire at market levels of USD 25,000/day at the time of fixing end last year, plus an equivalent number of days of bunker consumption [(32 tons/day at USD 620/ton (FO)] adds up nearly USD 500,000 more costs to the voyage.

Depending on freight market conditions, this extended transit time can also mean the vessel is unavailable for other employments during this period, representing potentially an opportunity cost not immediately evident from a direct cost analysis. Nonetheless, when weighing decisions based on financial and environmental considerations, the savings from canal dues and war risk premiums should be considered alongside the increased emissions and operational expenses associated with longer journey times via the Cape of Good Hope.