With domestic fuel prices soaring, Russia has imposed an immediate, ‘temporary’, ban on exports of diesel and gasoline (accounting for just under 75% of their total CPP exports, with naphtha, which is not included in the ban, accounting for most of the remaining volumes), with some relatively minor exemptions for Armenia, Belarus, Kyrgyzstan and Kazakhstan and very specific use cases (Russian military etc). A few further small exemptions were made on 25th Sep, excluding already agreed pipeline volumes for Transneft and excluding MGO and High Sulfur Gasoil.

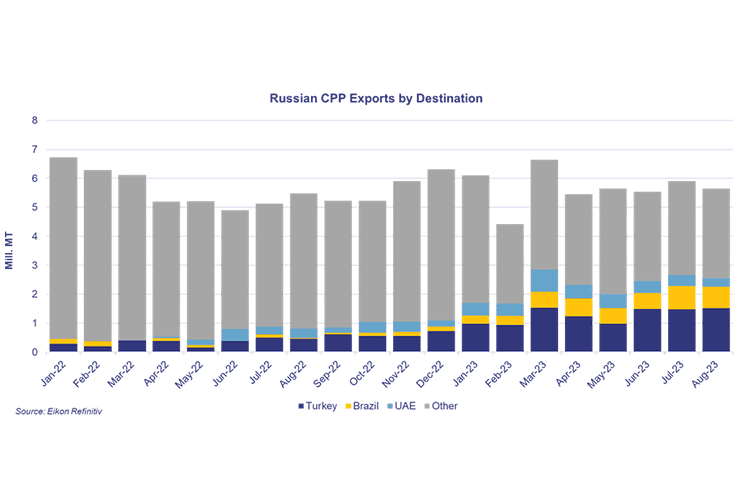

Since the imposition of the price cap, the vast majority of Russian CPP exports have been heading into Turkey, Brazil and the UAE. These were barrels, most significantly of diesel, that up until the ban, were predominantly heading short haul into European buyers.

Russian exports and the replacement barrels flowing into Europe has been the source of significant tonne-mile gains for clean tankers. Imports of CPP into Europe from further afield has seen the tonne-mile gains for imports in the region increase by 7.5% during the Jan-Aug period this year compared with the same timeframe in 2022.

Realistically the duration of the export ban will be the key defining feature that will have the most impact on clean tankers and it is being reported that the wider market expects the export ban to be relatively short in duration, with price movements on diesel relatively subdued for the time being, suggesting overall impact is expected to be minimal.

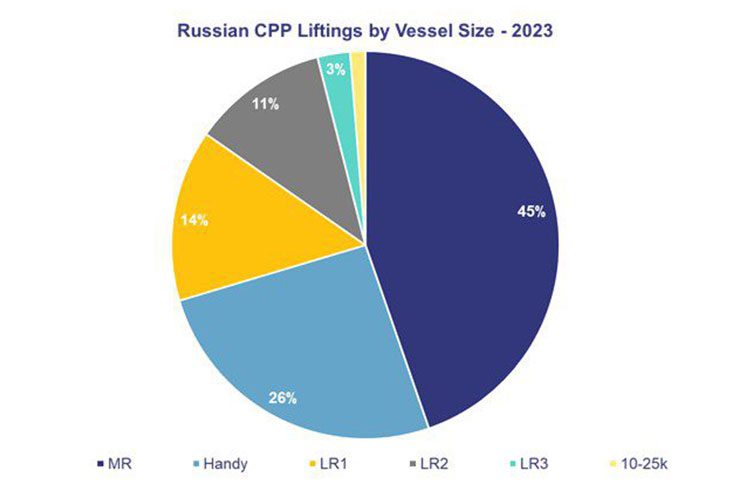

However, with the ban having arrived on the turn of the winter market for the northern hemisphere, when demand can peak quickly, the region could rapidly see demand growth for products, incentivizing significant flows into the region from further afield. With inventories for diesel limited, much of these replacement volumes are likely to come from the MEG or Asian refiners, significantly benefitting the larger LR sizes.

A significant question mark remains, at the time of writing, with the market waiting to see how those vessels (predominantly MR’s and Handies) that were regularly employed in lifting these now banned barrels will react to the lost trade. A close eye will need to be kept on the duration of the ban, and whether these vessels are able to find a home again in the ‘conventional’ market, or whether we see some of the older tonnage finally heading for recycling.